One home for all your investment needs - two years on

Irish Life is committed to delivering the best range of investment choices for brokers and your clients. We recognise that your clients have varied needs and different preferences when it comes to investing and our objective is to match our offerings with your clients’ investment needs.

With that in mind, in 2021 we engaged in a lengthy research process with brokers and our investment partners, firstly to understand if there were specific types of funds they could not get from Irish Life at that time for their clients and then with our investment partners to build out solutions to meet those needs.

In 2013 we had introduced our flagship multi-asset investment offering, MAPS to the broker market. In early 2020 we launched a range of bespoke multi-asset funds built specifically for Approved Retirement Fund (ARF) investors with our Retirement Portfolios (REPS). REPS were the first of their kind in Ireland designed and built around the very specific needs of retirees. In 2022, after evaluating the broker feedback we continued this evolution of our fund options with the launch of our FORUM and Setanta Multi Asset Active (SAMA) fund ranges as well as a new protected fund for more risk averse customers, Amundi Protect 90.

Over the last 10 years multi-asset funds have been the choice for the majority of investors and we now offer the widest option of multi asset ranges to choose from with the choice of 4 unique multi asset fund ranges. Multi-asset funds give investors diversified investment exposure across different types of assets providing access to a range of opportunities in single, professionally constructed and managed portfolios.

With our investment solutions your clients can choose to select their own investments from our range of over 80 funds that includes, multi asset, equity (both indexed and active), fixed income, property, commodities, alternatives, cash and other specialist funds or choose diversified ready-made portfolios from these multi-asset fund ranges across a range of different risk profiles.

Our funds are managed by four world class multiple award-winning fund managers, Irish Life Investment Managers, Setanta Asset Management, Amundi Asset Management and Fidelity International who have dedicated teams of experts on hand to uncover the best investment opportunities around the world. Our range of fund options also includes responsible investment options throughout our range of funds.

Alongside the new fund options, we have also introduced many new flexible pricing options across our pension and investment products to suit your advice process and offer competitive charges for your clients.

Multi-asset choice

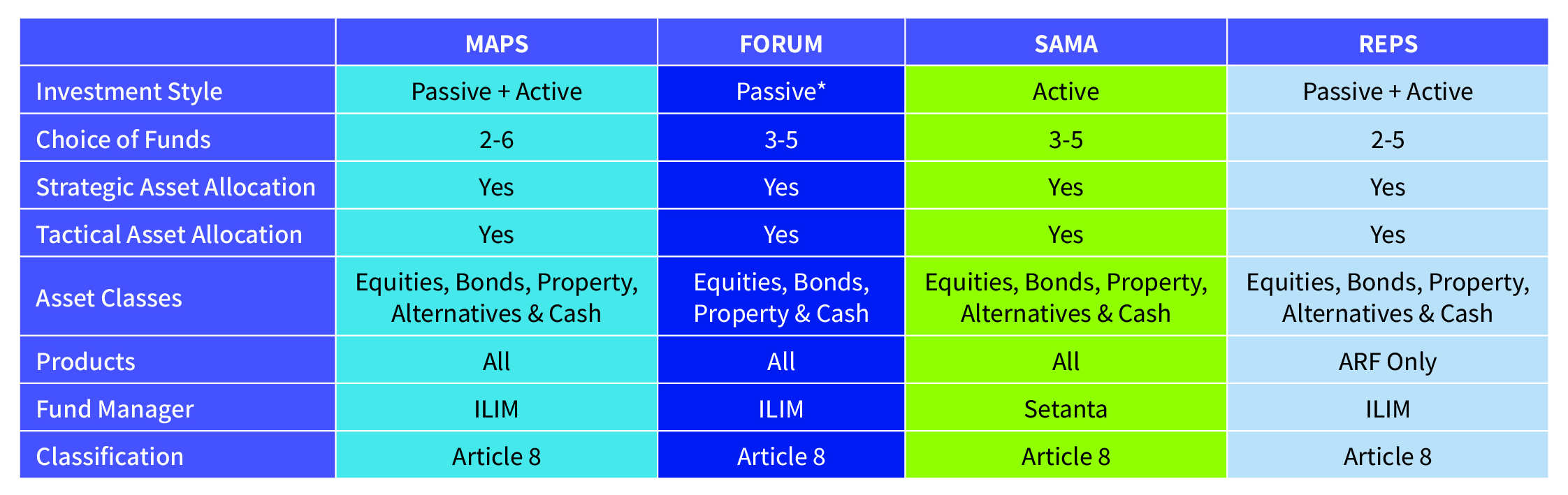

Since we launched the new fund options in 2022 we have often been asked by brokers which multi-asset range might best suit particular types of clients. Obviously, nobody knows your clients better than you do but we believe the different investment approaches of our multi asset fund ranges may appeal to specific types of clients. While all give broad diversified exposure across the major asset classes they are fundamentally different.

- MAPS is designed for clients looking for smoother long terms returns while managing volatility

- FORUM is designed for your clients looking for constant and diversified market exposure through the passive indexation approach

- SAMA applies Setanta’s renowned active approach of deep research and high conviction to a multi-asset range

- REPS is designed and built around the very specific needs of retirees.

Source Irish Life 2024

Although any new funds take time to get adopted the fact that the underlying strategies in the FORUM and SAMA multi-asset funds were long established and were leveraging off the long and successful multi asset investing expertise of ILIM and Setanta gave comfort to brokers considering them. From the launch of the newer funds we have been delighted to see the willingness to use the new options as well as the understanding of where they fit alongside our traditional offerings like MAPS.

Sustainability

When putting the new funds together we were also keenly aware of our responsibility to create long term sustainable returns for our clients and also incorporate environmental, social and governance (ESG) factors that can have an impact on the performance of our clients’ investments, and that the management of ESG risks and exploitation of ESG opportunities, particularly for a portfolio-wide issue like climate change, can add value to a portfolio. With this in mind, we made sure all of the funds would be classified as Article 8 funds under the EU Sustainable Finance Disclosure Regulations( SFDR).

Our clients trust us with their investments and to deliver on our core promise to them – to deliver better futures, that is our priority and we believe we can do this and at the same time as factoring in the responsible impact of our investment decisions.

Alongside the wide range of fund and pricing options to suit your advice process we also offer a range of digital solutions including our My Portfolio Builder and My Retirement Pathfinder to help you create portfolios to provide your clients with the advice they need.